chanel vat refund paris If I buy a Chanel purse at Chanel and it’s brand new, I get a full VAT refund at the airport, correct? If I buy a used/second hand Chanel from a . Unlocking new Levemetes are a great indication of where you should be leveling up. Levequests are unlocked every 5 levels from level 1-45. **Note: when changing Class, make sure you finish your Level 10 class quest from the Guildmaster in order to unlock Levequests for the new class you are leveling.

0 · where to get a vat refund

1 · vat refund paris 2024

2 · paris train station vat refund

3 · paris france vat refund schedule

4 · how much is the vat refund

5 · gare de lyon vat refund

6 · france vat refund

7 · chanel goyard vat refund

Fisher Leves Level 60 - The Peaks, The Fringes 👇 More details below!📌 PLAYLIST Fisher Quests: https://is.gd/deE7Qh📌 PLAYLIST Crafter and Gatherer Specials.

When you arrive at the EuroStar train station (if you are traveling to the UK), you can claim the VAT tax refund on the second floor after you go through security. Look for the sign. It is a self-automated machine. If you cannot find the machine, then I highly recommend you ask. Make sure you do this before you leave the . See more

Paris is one of the most popular places in the world to go shopping with some of the most iconic brands. Remember that if you're a tourist visiting Paris, or any EU country spend over €100.01 you're entitled to the VAT Tax refund. Happy to answer any questions in the . See more

Discover the ultimate guide to luxury tax-free shopping in Paris, including the VAT refund process. Learn how to navigate tax-free departments, process your forms at Charles . If I buy a Chanel purse at Chanel and it’s brand new, I get a full VAT refund at the airport, correct? If I buy a used/second hand Chanel from a . In France, there’s two major companies that processes VAT refunds for retailers: Global Blue and Planet Tax Free (formally Premier Tax Free). In my experience, Global Blue . Lift Paris shopping with our guide on how to get a VAT refund. Learn the steps for tax-free in Paris, from eligibility & shopping to claiming a refund.

where to get a vat refund

Currently the vat rate is 20%, which is nothing to sneeze at on luxury items. So for any of you dreaming about buying your first Chanel bag in Paris, that VAT return will be .

To help you make the most of tax-free shopping in France this spring, Wevat is accepting invoices from Louis Vuitton, Chanel, Dior, Céline, and Hermès for all eligible tourists traveling to France .> Several Paris department stores have tax-refund counters: Galeries Lafayette, the Printemps Haussmann, the BHV Marais, the Bon Marché Rive Gauche or the Samaritaine Paris Pont-Neuf. Shops in Paris offering tax refund: > Top luxury .

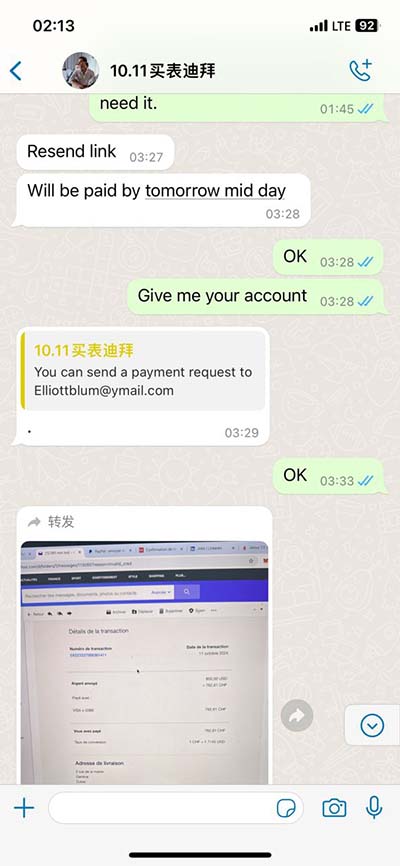

The validated tax refund export sales form must be submitted to the partner of our tax refund service provider (PREMIER TAX FREE) for an immediate refund in cash (at airports or in the . The VAT is 20%. How much of that you are refunded depends upon what the entity, making the refund on your behalf, keeps for itself. Instant refunds usually have the .

vat refund paris 2024

The ring costs 1,640 euros and it hit my credit card at ,779.73. My VAT refund took awhile (3 weeks) and I got 9.46 back onto my credit card.

Today I'm showing you what I purchased in Paris AND explaining how the VAT Refund works! When luxury shopping in Paris, or just shopping in Europe, from high. A recap on tax refunds. There are two main steps to getting a VAT refund on shopping: Get a refund form. Validate your refund form. Getting a refund form. There are two main ways you can get a tax refund form – .To help you make the most of tax-free shopping in France this spring, Wevat is accepting invoices from Louis Vuitton, Chanel, Dior, Céline, and Hermès for all eligible tourists traveling to France for a limited time! By getting a VAT refund with the Wevat tax refund app, you can expect to save up to 13% on your purchases! If you are buying designer pieces on your French vacation, you’ll want to make sure to get that refund. Currently the vat rate is 20%, which is nothing to sneeze at on luxury items. So for any of you dreaming about buying your first Chanel bag in Paris, that VAT return will be significant. Here’s how to make sure you get it! Paris VAT .

paris train station vat refund

Are Chanel Savings Still Possible in Paris? Factoring in the VAT refund for the same bag changes the narrative slightly. Despite the initial sticker shock when exchanged into dollars, the final calculations offer luxury shoppers a little bit of a break.The Cash Paris offices allow you to carry out your tax refund operations. You can obtain an immediate refund in cash in euros, on your electronic wallet (e-wallet) or a deferred refund on your bank card for any French or international slip previously validated with customs located before the security checks. at Paris-Orly airport:

Instead of the traditional 12% VAT Tax Refund back on items in France using the pen and paper method, you received 13.4% Vat Refund back using the New Wevat Digital Tax Refund process. For example, if you buy a Hermes bag for 5000 Euros, you will receive 670 Euros back instead of . With the VAT refund, you can buy the bag for €8,536, or ,240, making Chanel about 10% cheaper to buy in Paris, France compared to the US. Is YSL cheaper in Paris? Yes; being a French fashion house, Saint Laurent is cheaper in .

Which products are eligible for the Tax Refund ? Purchases over €100 made at Galeries Lafayette (Main Building, Men’s Department, Home & Food Department “Gourmet”, and Shopping and Welcome Center stores ).; The Tax Refund form must be completed within three consecutive days of purchase and original receipts must be attached; Purchases must be for personal use .

How does VAT works in Paris? . Discover how to get VAT refunds while shopping in Europe. This step-by-step guide provides valuable insights and personal experiences to help you navigate the process of . Let’s do some handbag math. The Noir Kelly 25 Retourne in Togo price in Paris was €7400. We received a 10% VAT refund, but had to pay 3.5% duty in US Customs. Effectively, we received a 6.5% refund of €481 bringing . Occasionally, stores can process a refund for you on site (called “instant refund”), but most use Global Blue, Premier TaxFree, or another third-party to handle the refund process. [Author’s note: I shopped at some of the .> Several Paris department stores have tax-refund counters: Galeries Lafayette, the Printemps Haussmann, the BHV Marais, the Bon Marché Rive Gauche or the Samaritaine Paris Pont-Neuf. Shops in Paris offering tax refund: > Top luxury brands like Louis Vuitton, Chanel, Hermès. > Fnac shops in Paris: Fnac des Halles, Fnac des Ternes, Fnac .

In our travels, the Hermes VAT refund is 10% while Chanel and Goyard gave 12%. How to Get a VAT Refund? There are two main methods of getting your VAT refund. Use the Store’s Refund Affiliate: VAT-free shopping stores often post signs indicating tax free shopping (like duty-free shops in the United States). How much is Chanel VAT refund in Paris? Meaning you could spend 100 Euros at Louis Vuitton, 100 Euros at Celine and 100 Euros at Chanel and as long as they are all in the same department store (Printemps, Galeries Lafayette, Bon Marche, etc) you would qualify for the total amount which is 300 Euro VAT tax refund. First, let’s talk VAT refunds for Paris. Remember, in order to qualify for VAT refund, . Now you know.) I looked at several pieces. With the CÉLINE being too small, and the Chanel and YSL ones being too big and bulky. This one was the perfect size for me. And so this trip, I finally picked it up. The price for this is €190 vs. 0 (plus .Answer 1 of 8: Hi! I'm getting my friend to purchase the Chanel bag in Paris. However, I am getting a bit confusing over the tax refund there and I do not want my friend to have a hard time with the tax refund while in Paris. . In all cases, merchandise for which a VAT refunded is given or requested must be shown in an unused condition at the .

paris france vat refund schedule

How much is Chanel VAT refund in Paris? Meaning you could spend 100 Euros at Louis Vuitton, 100 Euros at Celine and 100 Euros at Chanel and as long as they are all in the same department store (Printemps, Galeries Lafayette, Bon Marche, etc) you would qualify for the total amount which is 300 Euro VAT tax refund.

how much is the vat refund

gare de lyon vat refund

Level 70: Yanxia: 3 FATE prerequisite A Finale Most Formidable: Formidable: Level 80: Kholusia: 5 FATE prerequisite The Head, the Tail, the Whole Damned Thing: Archaeotania: Level 80: The Tempest: 6 FATE prerequisite Devout Pilgrims vs. Daivadipa: Daivadipa: Level 90: Thavnair: 2 FATE prerequisite Omicron Recall: .

chanel vat refund paris|paris train station vat refund